The Buzz on Investment Representative

The Buzz on Investment Representative

Blog Article

All about Tax Planning Canada

Table of ContentsThe Single Strategy To Use For Lighthouse Wealth ManagementThe smart Trick of Independent Investment Advisor Canada That Nobody is Talking AboutThe smart Trick of Investment Representative That Nobody is Talking AboutThe Best Guide To Independent Financial Advisor CanadaThe Only Guide for Lighthouse Wealth ManagementThe Basic Principles Of Investment Representative Getting My Retirement Planning Canada To WorkGet This Report on Investment ConsultantGet This Report on Retirement Planning Canada

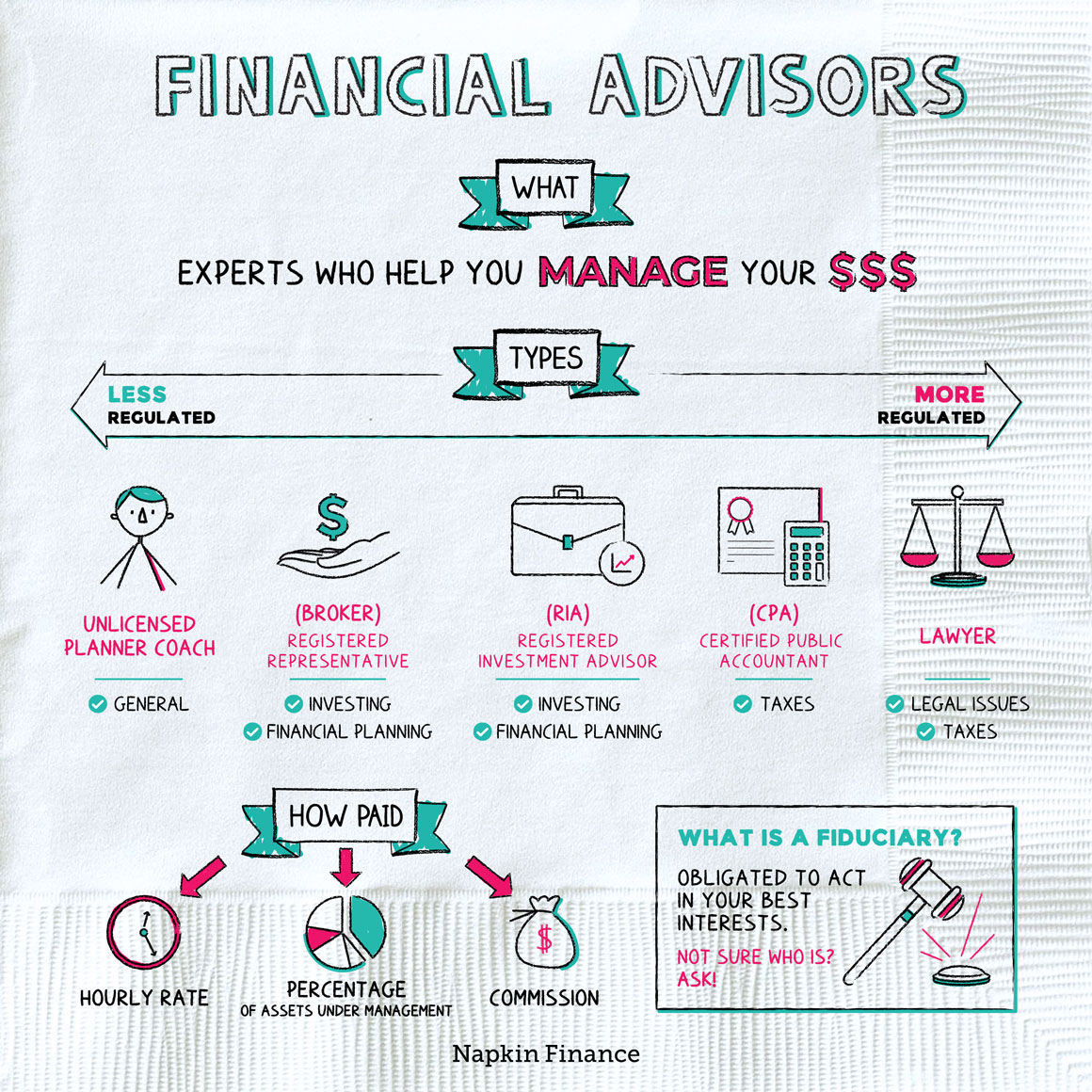

They make money by battery charging a fee for each trade, a set fee every month or a percentage paid regarding the dollar level of assets being maintained. People shopping for best expert should ask a few questions, such as: a monetary advisor that really works along with you will not become identical to a financial advisor just who works with another.Depending on whether you’re interested in a wide-ranging monetary plan or are simply just looking for financial investment advice, this concern will be important. Investment advisors have various methods of asking their clients, and it will surely often be determined by how frequently you deal with one. Definitely ask in the event the advisor uses a fee-only or commission-based program.

Lighthouse Wealth Management for Dummies

Even though you may prefer to invest some strive to choose the best monetary consultant, the work are worth every penny in the event the expert gives you good advice helping put you in a much better budget.

Vanguard ETF Shares commonly redeemable right with the providing investment apart from in large aggregations really worth millions of dollars (https://www.abnewswire.com/companyname/www.lighthousewealthvictoria.com_129054.html#detail-tab). ETFs tend to be at the mercy of industry volatility. When buying or attempting to sell an ETF, you certainly will spend or have the market rate, which can be more or less than net asset price

The Only Guide to Investment Representative

Normally, however, a financial consultant has some sort of training. When it’s perhaps not through an academic plan, it's from apprenticing at a financial consultative company (http://connect.releasewire.com/company/lighthouse-wealth-management-a-division-of-ia-private-wealth-341178.htm). People at a firm that happen to be nonetheless learning the ropes are usually known as associates or they’re the main management employees. As observed previous, though, many advisors result from some other industries

The 8-Second Trick For Investment Consultant

What this means is they need to place their customers’ desires before their, on top of other things. Some other economic analysts are members of FINRA. This can indicate that they might be brokers exactly who in addition provide expense guidance. As opposed to a fiduciary criterion, they lawfully must follow a suitability standard. This means that there was a reasonable basis for their investment suggestion.

Their particular labels frequently say every thing:Securities licenses, however, are more regarding the sales part of spending. Economic advisors who're additionally agents or insurance coverage agencies tend to have securities certificates. If they right buy or sell shares, ties, insurance policies products or provide financial guidance, they’ll require certain permits connected with those services and products.

Getting My Investment Consultant To Work

Make sure to inquire about about economic experts’ charge schedules. To find this info alone, look at the firm’s Form ADV this files using SEC.Generally communicating, there are two main kinds of pay buildings: fee-only. retirement planning canada and fee-based. A fee-only advisor’s main type of settlement is by client-paid charges

When attempting to realize how much an economic specialist prices, it is important to understand there are a selection of settlement techniques they may use. Here’s an overview of that which you might encounter: monetary experts may paid a percentage of the general assets under management (AUM) for handling finances.

Some Ideas on Private Wealth Management Canada You Should Know

59% to at least one. 18%, on average. financial advisor victoria bc. Usually, 1% can be regarded as the industry requirement for a million bucks. A lot of advisors will lower the portion at greater levels of possessions, so you’re investing, state, 1per cent when it comes weblink to basic $1 million, 0. 75% for the following $4 million and 0

Whether you require an economic advisor or not is dependent upon how much you may have in assets. You should also consider the comfort level with cash management topics. If you have an inheritance or have recently enter into a big amount of cash, next a monetary expert could help reply to your financial concerns and arrange your money.

Private Wealth Management Canada for Dummies

:max_bytes(150000):strip_icc()/ShouldIHireaFinancialAdvisor_1-eb901a47a822420894ee5539073c8473.jpg)

Those distinctions might seem obvious to people within the investment business, but some people aren’t conscious of them. They may think of economic preparation as similar with expense management and advice. And it’s correct that the contours between the vocations have cultivated blurrier in past times four years. Expense experts tend to be more and more centered on supplying alternative monetary preparing, as some buyers check out the investment-advice portion to get pretty much a commodity and they are pursuing broader knowledge.

If you’re looking for alternative preparation information: A financial coordinator is appropriate if you’re seeking broad financial-planning guidanceon the financial investment collection, but other areas of your own strategy besides. Search for those that call on their own financial planners and inquire prospective planners if they’ve gained the qualified economic planner or chartered economic expert designation.

The Best Guide To Retirement Planning Canada

If you want financial investment advice to start with: If you think debt program is during very good condition total however you need assistance choosing and overseeing your own investments, a good investment specialist could be the route to take. This type of people are regularly registered investment advisors or have employment with a strong definitely; these advisors and advisory companies are held to a fiduciary standard.

If you wish to assign: This setup makes feeling for really busy people that just do not have the time or interest to sign up inside the planning/investment-management process. It's also something to give consideration to for more mature people who're worried about the potential for cognitive fall as well as its impact on their capability to handle their particular finances or investment portfolios.

Getting My Lighthouse Wealth Management To Work

Mcdougal or authors you should never very own stocks in every securities pointed out in this post. Learn about Morningstar’s editorial policies.

How close you're to retirement, for instance, or perhaps the influence of significant existence events such as for instance matrimony or having young children. Yet these items aren’t in command over an economic coordinator. “Many take place arbitrarily plus they aren’t anything we could impact,” claims , RBC Fellow of Finance at Smith class of company.

Report this page